Seagoville auto title loans offer quick financial support with minimal paperwork and no credit check. Repayment is essential to avoid vehicle repossession. Eligibility criteria include regular payments, vehicle condition, and clear titles. Borrowers can reclaim their vehicles by paying off the loan in full, providing insurance and registration documents, ensuring a flexible and reliable borrowing process.

Thinking of reclaiming your vehicle after a Seagoville auto title loan? Our guide breaks down the process, eligibility criteria, and steps involved. Understanding how to navigate the repayment journey is crucial for getting your car back without hassle. Seagoville auto title loans offer a quick solution for cash needs, but knowing when and how to repay can prevent losing your vehicle. Discover the simple steps to reclaim ownership and get back on the road.

- Understanding Seagoville Auto Title Loans Process

- Eligibility Criteria for Loan Repayment

- Steps to Reclaim Your Vehicle After Loan

Understanding Seagoville Auto Title Loans Process

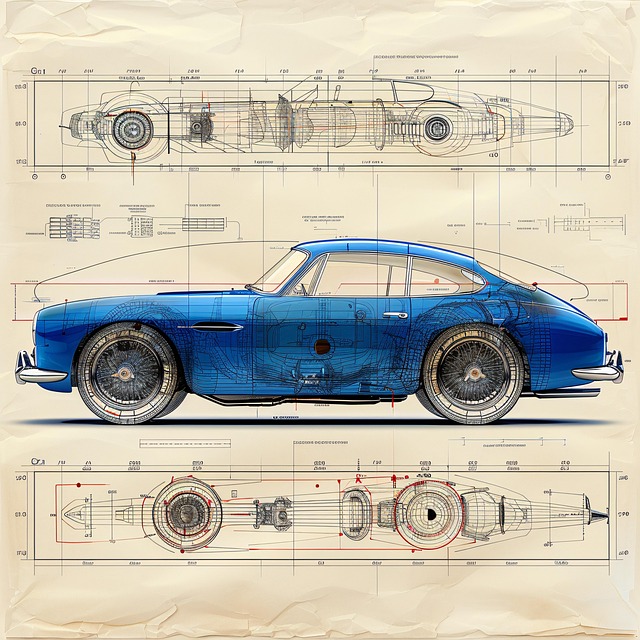

Seagoville auto title loans are a financial solution where borrowers can access funds by using their vehicle’s title as collateral. This process is designed to be straightforward and offers an alternative to traditional loans, especially for those with limited credit options or history. With these loans, lenders provide a fixed-rate loan against the value of your vehicle, allowing you to maintain possession while repaying the debt over time.

The beauty of Seagoville auto title loans lies in their accessibility; they often require minimal paperwork and don’t typically involve a credit check. This makes them an attractive option for individuals with poor or no credit. The loan approval process is swift, enabling borrowers to receive funds quickly. However, it’s crucial to understand that keeping up with repayments is essential to avoid potential consequences, such as repossession of your vehicle.

Eligibility Criteria for Loan Repayment

When considering repayment for a Seagoville auto title loan, understanding the eligibility criteria is essential. Lenders typically require borrowers to meet specific conditions to ensure the successful reclaiming of their vehicle after the loan period. One key factor is maintaining regular payments; consistent and on-time repayments demonstrate your ability to manage the loan responsibly.

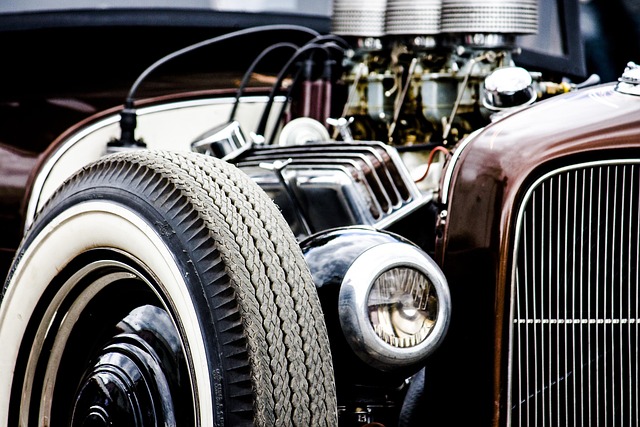

Additionally, lenders often assess the overall value of the vehicle, including its current condition and remaining resale value, especially for truck title loans. This ensures that the lender’s investment is secure. Given the nature of Seagoville auto title loans as secured loans, having a stable income and a clear title to the vehicle are crucial prerequisites. In some cases, borrowers might also need to provide proof of insurance to safeguard against any unforeseen incidents that could impact the vehicle’s condition.

Steps to Reclaim Your Vehicle After Loan

If you’ve taken out a Seagoville auto title loan but have since changed your mind or are facing financial difficulties, reclaiming your vehicle is possible. The process involves several steps designed to protect both the lender and the borrower. First, you’ll need to communicate with the lender directly to express your intention to reclaim the vehicle. Many lenders offer flexible options for repayment and reclaiming assets, especially if you’ve been making timely payments but are now facing unexpected challenges. They may work with you to arrange a payoff, which can often be facilitated through a direct deposit of the required funds into their account.

Once the loan is paid off in full, you’ll need to provide proof of insurance and any necessary registration documents to the lender. This ensures that your vehicle is properly transferred back into your name. Following this, the lien holder will release the title, allowing you to reclaim possession of your vehicle. The entire process is designed to be straightforward and swift, offering a quick approval and funding time, ensuring you can regain access to your asset in no time.

Seagoville auto title loans can be a valuable option for those in need of quick cash. By understanding the loan process, eligibility requirements, and reclaiming your vehicle after repayment, you can make informed decisions. Remember, clear communication with lenders is crucial throughout the entire process to ensure a seamless experience and regain ownership of your vehicle without any complications.